-

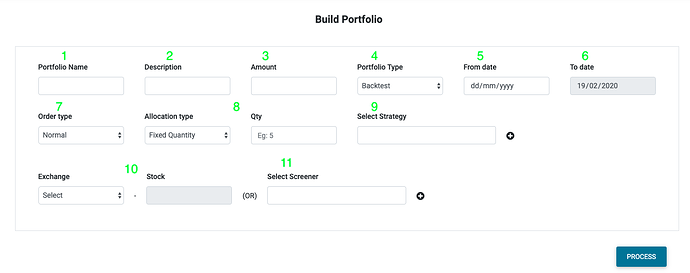

Name: Name the portfolio

-

Description: This is an optional field. Write a short description of the portfolio.

-

Amount: Typical amount you would trade for this portfolio

-

Portfolio Type: Select the appropriate portfolio type - Backtest, PaperTrade or Live

- Backtest: It is used to test your strategy on historical data.

- Paper trade: It is simulating on the live market by deploying virtual money. No trades are placed in the broker account but virtual orders are generated whenever a signal to buy or sell is triggered.

- Live: This would send the order to your broker account. This can be used only when you have provided the API details of your broker in Connect Broker page.

-

From Date: Select the date prior to today to backtest and Today for live and paper trade

-

To Date: For Backtest, it would until today but later than from date; for paper trade and live it would be any future date till you want to trade.

-

Order Type: Normal - for positional and CNC orders; and Intraday - for Intraday trading or MIS orders

-

Allocation Type: Select from the list

- FIxed Quantity: Quantity remains same for all the stocks selected in the portfolio irrespective of their price. For derivatives, the quantity would be a number of lots and not lot size. Eg: NiftyFutures Qty would be 1 and not 75 (lot size).

-

Equal Amount: Total Amount is equally allocated to all the selected stocks unless a max % is set. This is useful when the stock selection is based on the screener. There could be chances that the number of stock could vary at each rebalance period. For example, initially, the screener screened 10 stocks and equal allocation would be 10% to each stock and say on next rebalance only one stock got screened in this case equal allocation would allocate entire 100% of the amount. To avoid such scenario’s a limit can be placed using max %. So a limit of 10% would ensure that no stock is allocated more than 10% of the total amount.

For derivatives, the allocation would be based on the Margin required and not gross value. -

Equal Risk: It takes volatility into consideration for allocation. Allocation is as per below formula.

No. of Share = Portfolio Amount * Risk factor / ATR

ATR - average true range for last 20 period

Risk factor is the impact on basis points you want to have on your portfolio. It would vary from 0.1 to 1. Higher risk factor would mean higher allocation to stocks and vice versa.

Equal risk allocation type should only be used for equities and not for derivatives & intraday trading as their margin is calculated based on volatility.

-

Select Strategy: Select the strategy from the list created using the strategy page or click on “+” to create one.

-

Exchange and Stock: Select the stocks from the list based on exchange.

-

Screener: You have the option to either select the Stocks or select screener for the list of stocks you want to apply on your strategy. You can create a new screener by clicking on “+”.

Once you have input all the above fields click on the Process and you’ll get the table with list of stocks and allocation made to them. And finally, click on Confirm to create a Portfolio.

The created portfolio will appear in Dashboard in their respective list of Live, Paper trade or Backtest.