There are multiple ways to create a break out strategies. Break out strategies can be either candle breakout or an indicator based break out strategy.

CANDLE BASED

1. Opening Range Break Out:

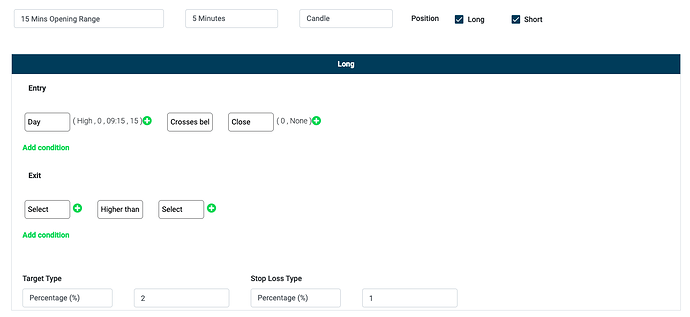

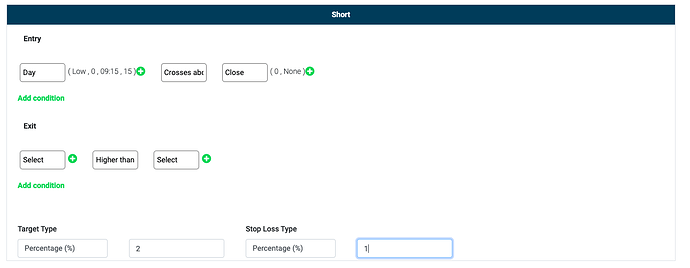

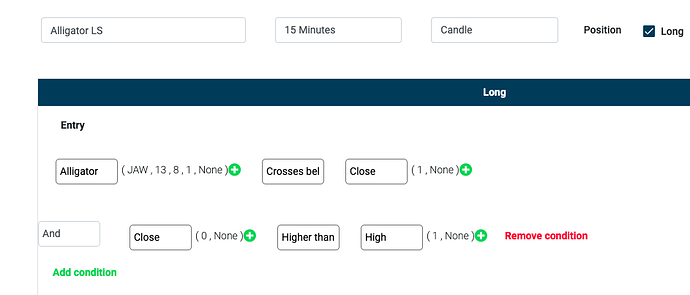

Below is the screenshot for both long and short 15mins opening range break out.

Conditions can be read as

Entry Long: High of today’s 9:15 AM candle crosses below (lower than) the close of the current 5 min candle.

Exit Long: Tager of 2% and Stop Loss of 1%

Entry Short: Low of today’s 9:15AM candle crosses above (higher than) the close of the current 5 min candle.

Exit Long: Tager of 2% and Stop Loss of 1%

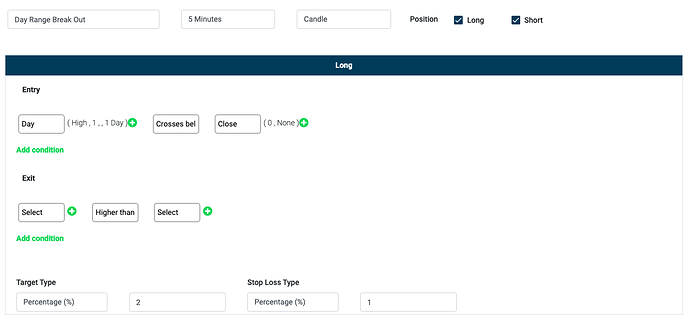

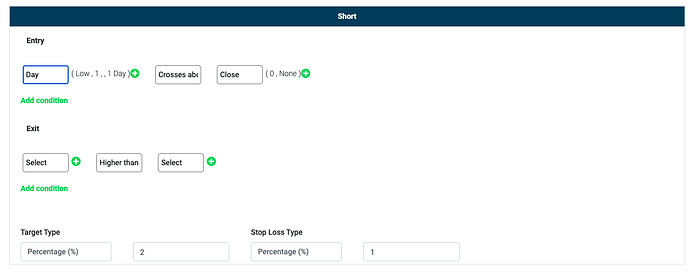

2. Previous day range break out:

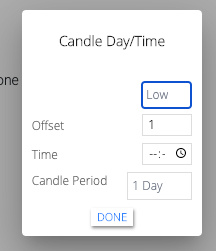

The only difference from 15 mins opening candle break out is to select candle period as 1day, remove time change the offset to 1 (meaning previous day). The indicator would look like as below:

Conditions can be read as

Entry Long: High of Previous Day (Yesterday) crosses below (lower than) the close of the current 5 min candle.

Entry Short: Low of Previous Day (Yesterday) crosses above (higher than) the close of the current 5 min candle.

I am using crosses below and crosses above conditions instead of lower than and higher than. This is to avoid retaking position when the target is met, as using higher than and lower than would always meet the conditions especially when the price is favourable.

Using our new Candle Day/Time function one can build a breakout of any candle of any given previous day.