We will evaluate these 7 strategies reported in ET starting with Bollinger Band.

Bollinger Band:

You can check out this post to understand Bollinger Band.

The ET article doesn’t provide more details to it’s buy and sell conditions. It just says.

- Buy when Close < LB and Sell when Close > UB without Stop Loss or Target.

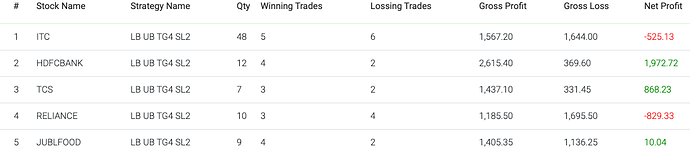

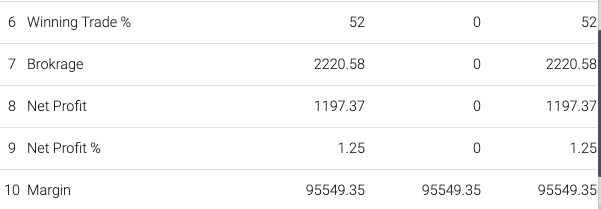

Here is the consolidated result of rules as above without SL and TG on some NSE stocks

on day candle with 1L as capital allocated equally.

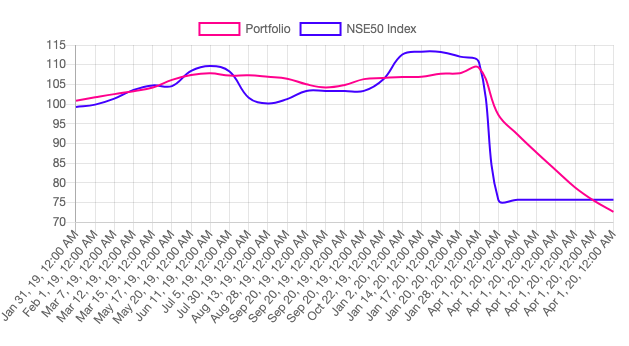

This strategy might work on a range-bound market but not on big trends. The free fall at the end is mainly because there was no condition to exit if the trade is not in favour.

We ran the same strategy with the Long only condition (as we selected candle as “day”), by making few changes:

Entry: Close < LB

Exit: High > UB or SL: 2% or TG: 4%

Below is the performance:

Stock wise results:

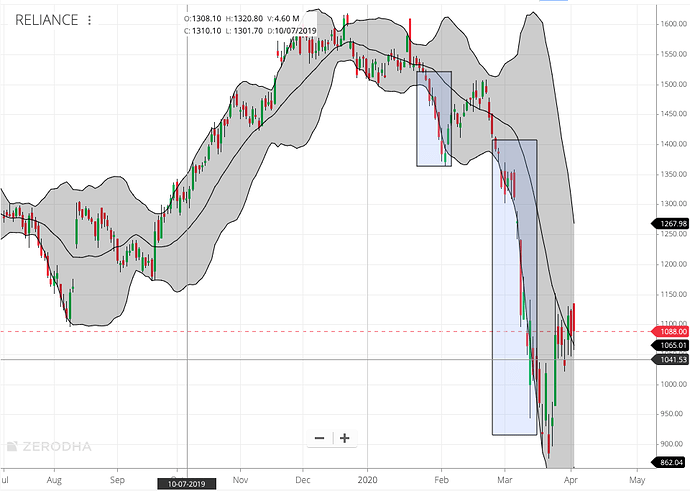

One of the problems with its entry condition is it takes the position when close < LB.

If you look at the chart highlighted in two boxes. The strategy would take position hit the SL in next day and meet the condition again in the next candle.

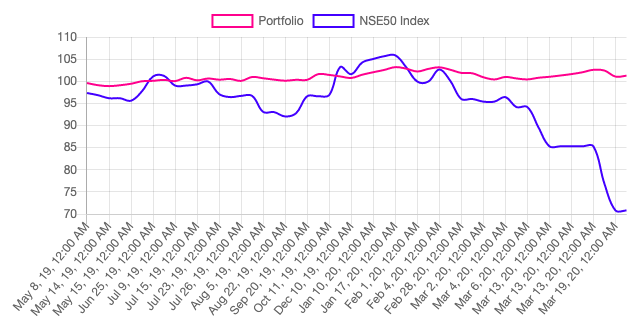

Few Changes to strategy.

Buy: Close> UB

Sell: Close< MB

This is strategy identifies the breakout and follow the trend.

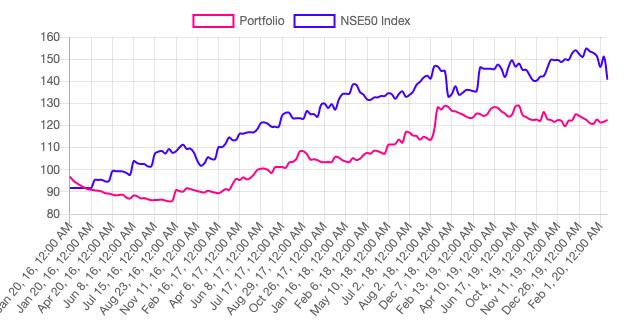

Here is the graph on the same stocks backtested from 1 Jan 2016 to 3 Apr 2020.

The graph shows results until mid-Feb 2020 because it closed all the positions by then. Effectively 23% return against 2.5% return of the index as on 3 Apr 2020.

This strategy is also very effective against the downside as it closes the position in any stock when it moves below 20 periods moving average.

Further comments are welcome!!