- Can I create a favourite list of stocks and apply my strategy only on those stocks?

Yes, you can use our screener to do that. In the stock group select custom stock and from the list of stocks select your favourite stocks.

- Can I place a fixed price as an Entry price which is above the current market price?

Yes. This can be done through strategy creation page using the Custom Value from indicators list.

Eg: Close[0] Crosses above Custom Value [500]

- Can I place a fixed price as SL and how many days will it remain live in the system or should I manually place my fixed price SL order every day?

Yes. This can also be done through Create Strategy page. We do not send SL orders to brokers. Based on the candle interval you have selected while creating the strategy, on a live market, our system will check for the stop loss every candle interval and would send the market order to your broker account the moment it is triggered.

No manual intervention is required. Our system will take care of Stop Loss.

- Which broker should I open the account?

Currently, we have Fyers and Zerodha’s API integrated. Adding more.

- How many custom strategies can I build and save?

Currently, there is no limit to the strategies you create.

- How many strategies can we deploy at any given time?

Currently, there is no limit to the number of strategies that can be deployed live.

- Monthly Broker API charges?

Fyers - API cost is Nil.

Zerodha - Rs.2000 per month.

- Apart for monthly charges do you charge any Extra commission or brokerage per trades which are executed through your platform?

Yes. Please refer to our pricing plans section in our home page bottom - https://inuvest.tech/

- Are the (ADX +DI) & (ADX -DI) indicator available?

Yes.

- Can I change the indicator’s period or values on any time frame?

Yes.

- Do the platform support Multi-Time Frame strategies?

Yes. In the Create Strategy page, when you select any indicator, it would also have an option to Candle Period. If you do not select any candle period by default it would take the candle period of the strategy.

- Can I enter or exit a live trade based on intraday Moving Average crossover or a fixed Stop loss price whichever is earlier?

Yes. The exit trade would be earlier of Exit Strategy or Target or Stop Loss.

- Are NSE currency derivatives supported?

Yes.

- Any extra data feed charges?

No.

- Can we deploy intraday trading strategies on 5-minute candles?

Yes.

- Which all Indian Exchanges are supported?

NSE, BSE (for non-NSE stocks), NFO, CDS, MCX.

- In Live trading how many strategies can we run simultaneously?

Currently, there is no limit.

- May I know your Monthly Pricing Plans?

Please refer to the pricing section of our home page. https://inuvest.tech/

Or subscription section once you sign in.

- Can I build custom strategies without any programming knowledge & backtest them?

Yes. Our strategy and screener page are quite flexible. Which can enable you to do any mathematical operation between indicators, select specific candle, build a candle based pattern, combine multiple conditions, multi-timeframe conditions checking etc.,

- Is this platform cloud-based or do we have run our computer 24/7?

Our platform is hosted on the cloud servers. Your internet or computer performance has no impact on it.

- Does your system has money management feature? e.g. if I have 1L of capital in my trading account and I trade in cash, the number of stocks can be determined by the system?

Yes, this is taken care when you build the portfolio. We have three methods to allocate your capital:

-

Equal Amount: This would allocate your capital equally to the list of stocks you have selected. Further, you could also restrict the allocation, for eg: allocation to each individual stock should not exceed 10% of total capital. For intraday or derivatives instruments, their margin is used for the purpose of allocation.

-

Fixed Quantity: This method would select the quantity specified for each stock irrespective of the amount.

-

Equal Risk: In this method the amount is allocated based on the volatility of the stock and the risk factor specified by you. Higher the volatility lower the allocation and lower the volatility higher would be the allocation. This method is used to build a sustainable portfolio making sure each stock in the portfolio should have the same impact on the performance. A risk factor of 0.1 would indicate that the impact on the portfolio return by a single stock should be 10 basis point.

- Do you have your own strategy that I can work upon? or you can implement my strategy?

We have the list of backtested and live trading strategies on Trading Robots page. These would be available for subscription.

Our strategy creation page is very simple to use. Hence, you would be able to create your own strategy. In case you need any support we would be happy to help you. Either write to us at support@inuvest.tech or raise your query in this support page.

- I would like to see the backtest data of your most trusted strategy if possible

Please check our Trading Robots section once you login at inuvest.tech.

- I would also require VPS, as I can’t put my system running during all market hours?

No, our platform is hosted on a cloud server. Your computer or internet performance does not impact our system.

- Which all segments are supported?

Equity, Equity Derivatives, Currency Derivatives and Commodities Derivatives.

- How much monthly return is expected?

This depends on the strategy you create.

- I work with Upstox/Fyers broker. Do you support that broker?

We have integrated Fyers API. Would integrate Upstox in the near future.

- If I provide you some strategies, can you implement in your system?

Yes.

- What about stock selection? Is there any provision to determine the pool of stocks only?

Yes. You could use our screener to select the stocks based on the conditions specified by you from the group of NSE50/100/200/500/NFO or from the your own custom stocks.

You can integrate the screener to your portfolio so that it can dynamically select the stocks at a specified interval (rebalance period).

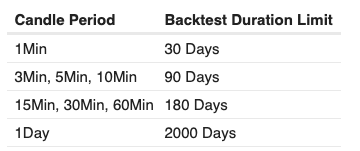

- What is the Backtest period limit?

The backtest period limit depends on the candle interval you have selected while creating strategy.

Here are the current limits for a single backtest.

We are working on to increase these limits.

- If my BO is executed in part and part order is in pending. After that, if I CANCEL the BO; my all the BO orders will be cancelled (the executed and the pending orders too . ALL) AM I RIGHT?

We do not send bracket orders from our system. Say if your strategy is to buy at 100 with a stop loss and target of 5 and 10. Than first our system will send the market order when the buy signal is generated at 100. It will send another market order for either target or stop loss, whichever is met first.

- How safe are my strategies, will others be able to view it?

Your strategies are only for your use, no one would have access to them. If you wish to make your portfolio public (publish to Trading Robots), other users could only view your portfolio results and not your strategy conditions.

- In future, if I discontinue, then what will happen to my strategies?

If you decide to discontinue, you could delete those strategies and it would be deleted permanently from our system.

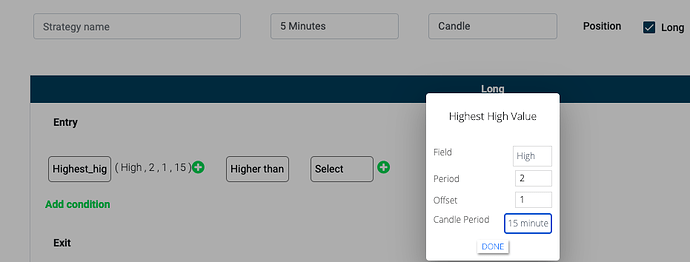

- Can I mention Entry as previous 2 bars High on any time frame?

Yes. You could use Highest High Value indicator with period 2 and select any candle time frame.

- Can I enter Trailing Stop Loss as previous 3 bars low on any time frame?

Yes, you could use the Lowest Low Value with period 3 and select the desired candle period.

- Is position size (Quantity) is calculated automatically if I give Entry, SL & Risk(%) per trade?

We have three methods to calculate position size:

-

Equal Amount: This would allocate your capital equally to the list of stocks you have selected. Further, you could also restrict the allocation, for eg: allocation to each individual stock should not exceed 10% of total capital. For intraday or derivatives instruments, their margin is used for the purpose of allocation.

-

Fixed Quantity: This method would select the quantity specified for each stock irrespective of the amount.

-

Equal Risk: In this method the amount is allocated based on the volatility of the stock and the risk factor specified by you. Higher the volatility lower the allocation and lower the volatility higher would be the allocation. This method is used to build a sustainable portfolio making sure each stock in the portfolio should have the same impact on the performance. A risk factor of 0.1 would indicate that the impact on the portfolio return by a single stock should be 10 basis point.

- Can I give 2 Exit conditions, and if any one of them is met then the trade should be closed automatically?

Yes, you could give multiple exit conditions by combining with “AND” & “OR” conditions. Also, you could specify “Target” and “Stop-Loss”. Exit would be on first of your Exit Condition or Target or Stop Loss.

- How to open a paper-less Algo trading account with your company and what documents or proofs are to be submitted?

Currently, No KYC is required. You could signup with your email account. If you wish to trade live than you might have to open a broker account with either Zerodha (API cost - Rs.2000 per month) or FYERS (Nil API cost). Keep checking our broker partners list on our home page as we are integrating more brokers.