Aroon period: 40

Buy: AroonUp crosses above Aroon down

Sell: Aroon Down > AroonUp and Aroon Down > 50. ( Will not exit unless there is a downtrend)

No Stop loss and target.

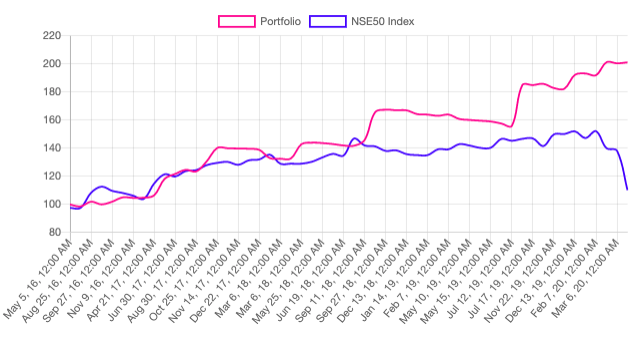

Here is the equity graph for the backtest from 1 Jan 2016 to 28 Apr 2020.

A return of 100% over 5 years against an index return of almost nill during the same period, with a portfolio drawdown of ~15%.

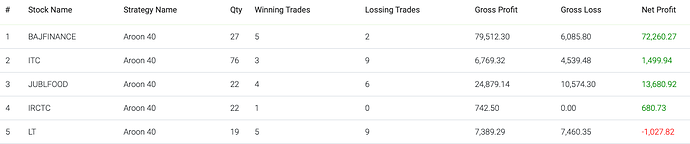

Here is the individual stock level performance.

This is on investment of 100000 equally allocated to all the 6 stocks. Approx 16000 to each stock.

Now one of the problems with the above backtest is stocks itself. Most of the stocks we picked have been in good trend during the backtest period and we are faced with the problem of overfitting.

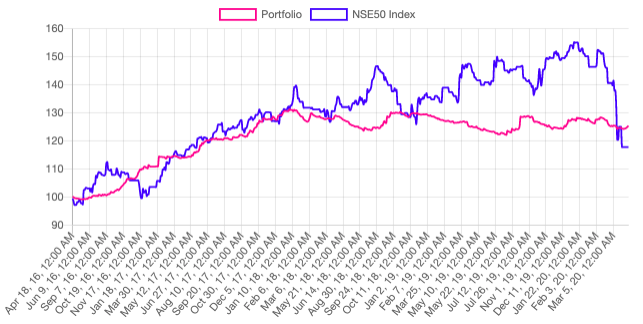

Aroon on Nifty50 stocks:

I ran the same strategy on all the nifty 50 stocks

Clearly good performance in a bullish market but loses its value on the sideways market. If you happen to pick those stocks which are moving sideways and give a false trend signal, the strategy might not work.